- Alfred Rappaport Shareholder Value Pdf Readers

- Alfred Rappaport Shareholder Value Pdf Reader Download

Subjects

getAbstract Summary: Get the key points from this book in less than 10 minutes.

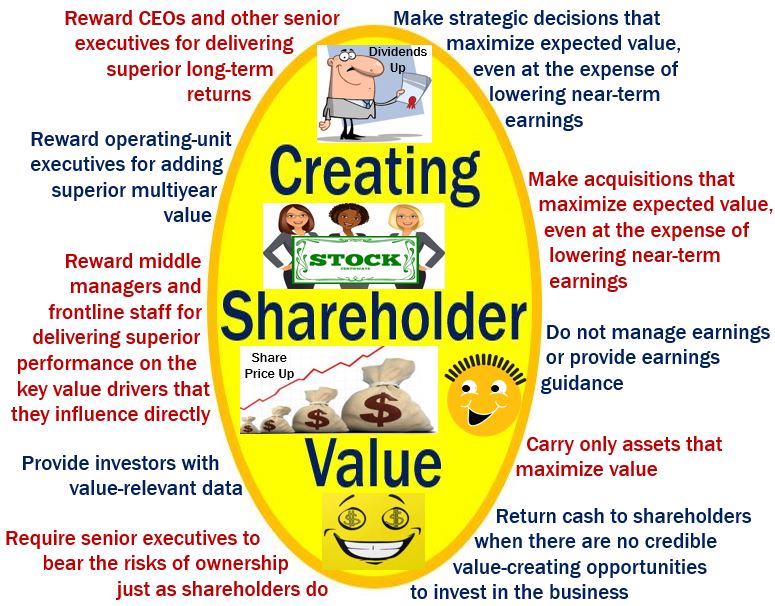

LEMKE Professor of Accounting University of Alberta ALFRED RAPPAPORT, Creating Shareholder Value (New York and London: The Free Press and Collier Macmillan Publishers, 1986, pp. Xv, 270, $23.95). Companies profess devotion to shareholder value but rarely follow the practices that maximize it. What will it take to make your company a level 10 value creator? By Alfred Rappaport I SIMON PEMBERTON Ways to Create Shareholder Value. Creating Shareholder Value A Guide For Managers And Investors by Alfred. Creating Shareholder Value, Alfred Rappaport provides managers and investors with the practical tools needed to generate superior returns. After a decade of downsizings frequently blamed on shareholder value decision making, this book presents a new and indepth. Alfred Rappaport directs Shareholder Value Research for L.E.K. Consulting and is a Professor Emeritus at Northwestern’s Kellogg School.Michael Mauboussin is Credit Suisse First Boston’s Chief U.S. Investment Strategist.

For the past 12 years, The Wall Street Journal has published Dr. Alfred Rappaport's brainchild, the Shareholder Scoreboard. This special section lists 1,000 of the largest U.S. corporations (representing 90% of all listed equity values) and shows statistically how 'shareholder-friendly' each one is. This journalistic feature popularizes Rappaport's 'Shareholder Value' (SV) theory among institutional and individual investors. Investors use this theory to make equity commitments that reflect the author's economics-based criteria. Frankly, the lay reader who has not majored in economics, or in corporate accounting and finance, will find Rappaport's book abstruse. But it leads the way for the informed, inquisitive investor who seeks 'business enlightenment' and Wall Street success. Do not be thrown off by the original 1986 print date. A classic is just that, a book that can be read and wisely used for decades. The small, silent shareholder revolution that Rappaport started is far from over. By now, shareholder analysis has become part of the mainstream for hundreds of big companies (though they accepted it gradually). SV is far from perfect as a corporate strategy indicator. The true worth of this book for CEOs and other executives resides in its lessons for implementing the SV approach throughout a corporation. getAbstract recommends it to all three informed constituencies of every public corporation: executives, employees and shareholders.

Alfred Rappaport Shareholder Value Pdf Readers

Book Publisher:

Alfred Rappaport Shareholder Value Pdf Reader Download

Copyright © 1986, 1998 by Alfred Rappaport

Reprinted by permission of Free Press, a division of Simon & Schuster, Inc., N.Y.

Publication Details

Format

- Kindle Book

- OverDrive Read 62 KB

- Adobe PDF eBook 123.9 KB

- Adobe EPUB eBook 62 KB

Where Are the Shareholders' Yachts?

The idea that a public corporation's main task is to make its shareholders wealthier caught on in the last generation and it is likely to become a universal practice in the next generation. This orientation, known as the 'Shareholder Value' (SV) approach, weakens corporate managers' old, established habit of focusing on generating rapid quarter-by-quarter earnings results. Instead, it forces them to look ahead to fulfill their stockholders' best interests. This change was driven by the 1980s wave of corporate mergers and consolidations, where managerial mistakes created red-hot opportunities for cheap takeovers by raiders and other jackals.

Shareholders have even voted out shortsighted CEOs who won quarterly skirmishes, but lost big-time battles. Such shop cleaning effectively dethroned ranking executives at more than a half dozen Dow Jones Index companies.

Consequently, to save their jobs and serve their shareholders, executives increasingly have turned to longer-term strategies that offer the most logical tactics for their companies and, as a consequence, increasingly satisfy the investment criteria of their shareholders...